Since you are an existing Standard Chartered credit card client, you do not need to submit any additional documentation! It's simple.

| Category of Spends | Monthly Spends | Cashback Earned (Per Month) | Annual Cashback (Per Annum) |

|---|---|---|---|

| Online Spends | INR 50,000 | INR 1,000 | INR 12,000 |

| Offline Spends | INR 50,000 | INR 500 | INR 6,000 |

| Total | INR 1,00,000 | INR 1,500 | INR 18,000 |

Joining / First Year Fee of INR 499 + GST waived as a Special Offer (Not applicable for existing SCB credit card holders)

Renewal Fee - INR 499 + GST

Renewal Benefits - Renewal fee reversed on spends greater than INR 120,000 in the previous year

Clients are eligible for cashback with Smart credit card, details below -

|

|

Cashback % |

Max cashback per month |

|

Online Transactions |

2% |

INR 1,000 |

|

Offline Transactions |

1% |

INR 500 |

Value of cashback is equivalent to INR 1.

There are no minimum transaction value or minimum spends requirements for clients to be eligible for cashback. Please see the below table for more details

|

To qualify for cashback |

Minimum transaction value |

Minimum spends in category |

Max cashback per transaction |

Max cashback per Month |

|

Online Transactions |

NA |

NA |

INR 1,000 |

INR 1,000 |

|

Offline Transactions |

NA |

NA |

INR 500 |

INR 500 |

No, fuel transactions are not eligible for cashback

No, cash withdrawal transactions are not eligible for cashback

If the cashback if redeemed prior to the date of your credit card statement cycle, the cashback will be adjusted against the total outstanding. Otherwise, the cashback will be adjusted in the next statement cycle.

Cashback can be redeemed on multiple cards at the same time. However, conditions on minimum redemption amount will apply for Smart credit card.

No, the redemption fee of INR 99 is not applicable on redemption of cashback.

The special interest rate of 0.99% per month and Nil processing fee is valid only on eligible transactions as defined by the Bank. The client can avail the EMI facility via Online Banking or SC Mobile or any other channels of Standard Chartered Bank. The facility is also available for any EMI conversions undertaken at the point-of-sale with the merchant (retail outlets or e-commerce websites).

The client can use the following modes to convert the transactions

Call our phone banking team on 080 39401166 / 66011166 and place your request for EMI conversion or SMS KBE to +91-9223010121 to get a callback.

Respond to the SMS received just after you spend on your credit card to convert eligible transactions into easy EMIs.

If you have missed converting your credit card purchase to an EMI at a physical or online merchant, you can login to Online banking or mobile banking and place a request at your convenience for the eligible transactions.

You can convert your transactions at select retail outlets or e-commerce websites at the special EMI rates.

No, for clients availing the Smart credit card, no change of Statement Date within the first 90 days of card setup is possible.

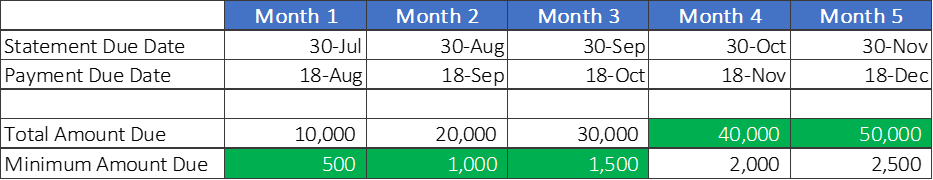

Please see the detailed illustration below to understand the functioning of the extended interest-free credit period.

Scenario 1: For a customer, who wishes to avail the extended interest-free period, the customer is required to make a payment of the Minimum Amount Due as per the first three statements for Smart credit card, and the Total Amount Due as per the fourth statement (30 Oct) for Smart credit card by Payment Due Date (18 Nov) to continue to keep the account in good standing

Scenario 2: In case the customer does not make the payment of Total Amount Due in the 4th statement (30 Oct) - interest will be charged on Total Amount Due as per statement dated 30 Oct from 31 Oct till such time total payment is received by the Bank

Scenario 3: In case the customer does not make the payment of Minimum Amount Due in Month 1 (30 Jul)

(a) customer will not be eligible for the 'extended interest-free credit period'

(b) late fees will be levied in the statement generated on 30 Aug

(c) interest will be charged on Total Amount Due as per statement generated on 30 Aug,

from 31 Aug till such time total payment is received by the Bank

The interest-free credit period offer will be forfeited / withdrawn automatically, and interest will start accruing from 3rd statement on retail balance outstanding in 2nd statement. All retail transactions done post generation of Statement 3 will start accruing interest. The total interest accrued will reflect in the 4th credit card Statement.

This feature is not applicable on cash transactions done on the Smart Credit card. Cash transactions will continue to attract interest rate of 3.75% per month.

The feature is not applicable on any Loan on Card products, EMI or Balance transfer offerings of the Bank. It is applicable only on the Retail transactions. The Statement for these products is shared separately with as Instabuy account statements where the payments needs to be serviced separately.

You can apply online and get an instant in-principle decision in minutes. A Bank representative will get in touch with you once you have submitted your application online successfully to complete the documentation requirement. You can expect to get your credit card, subject to final Policy and verification checks of the Bank, within 7-15 days from the time you submit your documents and signed application form, although it may take longer in some cases.

The credit limit will depend on various factors like your income, credit history, etc. Your credit limit is not a permanent figure and can be increased or lowered at a later date depending on your spends and repayment behaviour.

Yes, you can apply for an add-on card. There won't be a separate credit limit for the add-on card.

A grace period is interest free period for you to pay your credit card balance in full without any interest rate charges. The grace period is calculated based on your billing cycle and not from the date of the transaction.

The minimum amount due every month shall be higher of the following (a)5% of statement outstanding or (b) sum total of all installments billed, interest, fees, other charges, amount that is over limit and 1% of the principal or Re 250.

All overseas transactions are levied with a 3.5% transaction fee.

The monthly interest rate is annualized to arrive at the annualized percentage rate (APR). Monthly interest rate of 3.75% pm is annualized to arrive at an APR of 45% for all Standard Chartered Credit Cards. However, for all instant credit card variants, the monthly interest rate is 1.99% pm (APR of 23.88%). Cash transactions will attract an interest rate of 3.75% pm (APR of 45%).

Payment of your Card bills can be done by the following means:

• Online banking

1. Bill Desk: From different bank accounts directly to your Card account. Visit https://www.billdesk.com/pgmerc/standardchartered/index1.htm

2. NEFT / IBFT: From your bank account directly to your Card account by quoting the IFSC code SCBL0036001 and the address as MG Road, Mumbai.

3. Visa Money Transfer: In case of Visa franchisee credit cards, pay through your bank account using Visa Money Transfer.

4. Standard Chartered Online Banking: Standard Chartered account holders can pay through an account transfer.

• NACH:

NACH (National Automated Clearing House) can be initiated by submitting an NACH form authorizing transfer of funds. This form needs to be attested by the bank from where the payment needs to be made.

• Cheque/Draft Payment:

Dropping a cheque or a draft in favour of your Standard Chartered Bank Card no. xxxx xxxx xxxx xxxx (your 16 digitCard number) into any of our Cheque Collection Boxes. Visit www.sc.com/in for the complete list of the locations of Cheque Collection Boxes.

• Cash:

Cash payments can only be deposited at our branches using teller facilities.

Please refer to the Important Information Document/Most Important Document for more details.

You must notify us immediately if you become aware that your Credit Card has been lost,stolen or misused. Ahmedabad, Bangalore, Chennai, Delhi,Hyderabad, Kolkata, Mumbai, Pune- 3940 4444 / 6601 4444 Allahabad, Amritsar, Bhopal, Bhubaneswar,Chandigarh, Cochin / Ernakulam,Coimbatore, Indore, Jaipur, Jalandhar, Kanpur, Lucknow, Ludhiana, Nagpur, Patna, Rajkot, Surat, Vadodara - 3940 444 / 6601 444 Gurgaon, Noida -011 - 39404444 / 011 - 66014444 Jalgaon, Guwahati, Cuttack, Mysore,Thiruvananthpuram, Vishakhapatnam, Mathura, Proddatur, Dehradun, Saharanpur -1800 345 1000 Siliguri -1800 345 5000

You must notify us immediately if you become aware that your Card has been lost,stolen or misused. Ahmedabad, Bangalore, Chennai, Delhi,Hyderabad, Kolkata, Mumbai, Pune- 3940 4444 / 6601 4444 Allahabad, Amritsar, Bhopal, Bhubaneswar,Chandigarh, Cochin / Ernakulam,Coimbatore, Indore, Jaipur, Jalandhar, Kanpur, Lucknow, Ludhiana, Nagpur, Patna, Rajkot, Surat, Vadodara - 3940 444 / 6601 444 Gurgaon, Noida -011 - 39404444 / 011 - 66014444 Jalgaon, Guwahati, Cuttack, Mysore,Thiruvananthpuram, Vishakhapatnam, Mathura, Proddatur, Dehradun, Saharanpur -1800 345 1000 Siliguri -1800 345 5000